Chinese October bauxite import down by 8.1% MOM

2013-11-26 09:38:43 [Print]

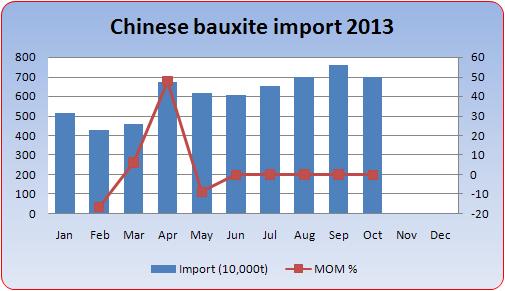

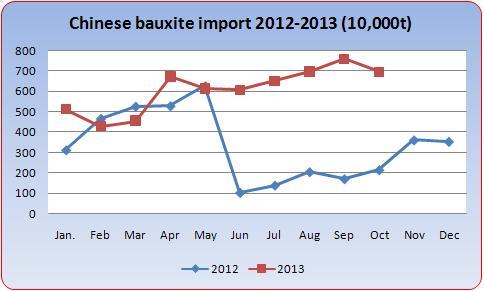

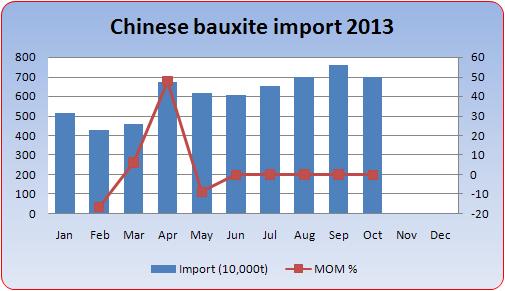

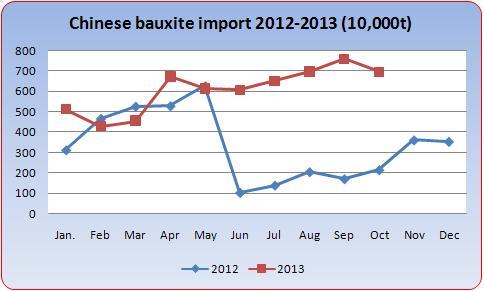

BEIJING (Asian Metal) 26 Nov 13 – According to revised data from China Customs, Chinese total bauxite import in October is around 6.97 million tons, down by 8.1% MOM. The import from January to October climbs up by 85.95% year-on-year to 60.34 million tons.

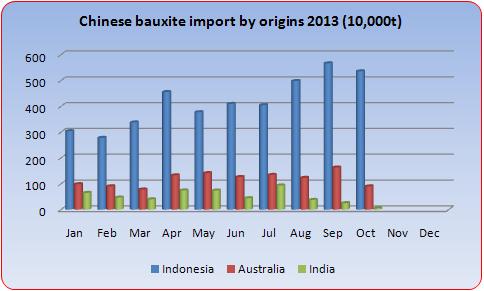

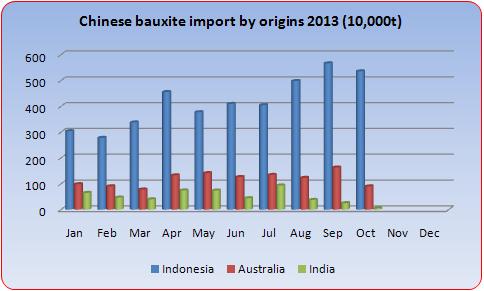

As the data showed, Indonesian origin bauxite import in October is around 5.36 million tons, down by 5.4% MOM. The import volume from January to October is around 41.05 million tons, up by 75.51% year-on-year.

China imported around 903,000t of bauxite from Australia in October, down by 44.7% MOM. The import from January to October was around 11.79 million tons in total, up by 48.32% year-on-year.

The bauxite import from India was around 52,000t in October, down by 79.5% MOM. The total import from January to October was around 5.01 million tons, up by 666.9% year-on-year.

As a whole, the bauxite import from Indonesia, Australia and India declined in October. However, the total import from January to October jumped greatly compared to 2013, especially for India bauxite. Against the Indonesia bauxite export ban policy, Chinese bauxite buyers purchased large stocks in the past three quarters, leading to rising bauxite import in 2013. Entering the fourth quarter, Chinese buyers reduced import due to high-held stocks and tight capital turn-over. Therefore, Chinese bauxite import went down quickly in October. It is predicted that Chinese bauxite import will go down continuously in the coming two months.

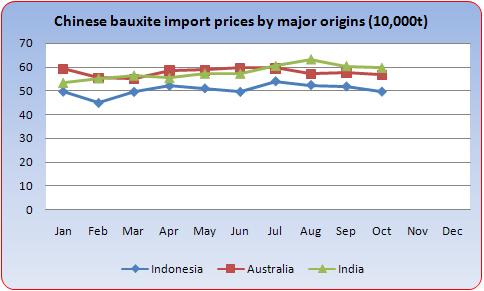

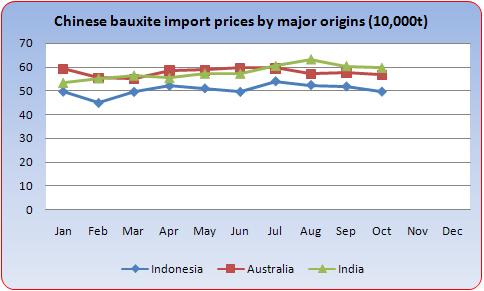

Given the reducing bauxite import, Indonesia bauxite suppliers were forced to lower offers, leading to slight price decrease. The price for Indonesia bauxite reduced from USD52.5/t to USD51.9/t CIF China and the price for India bauxite declined by around USD3/t to USD60.56/t CIF China. Australia bauxite price remained stable. When Chinese buyers cut purchase, India bauxite usually is affected greatly because of its unstable quality.

Chinese buyers turned to purchase high-grade bauxite after the import decrease. For example, it is hard to sell bauxite with Al lower than 45%. India bauxite buyers also focus on bauxite with Al higher than 45%.

Since there is still no change for Indonesia policy, the bauxite suppliers from Indonesia may reduce greatly next year. The suppliers who own export right may focus on some large-scaled miners like Harita and Antam. Therefore, the bauxite price may go up further in 2014. Part Chinese traders also want to replenish high-grade bauxite stocks and sell in future right time.

Chinese bauxite import in October:

As the data showed, Indonesian origin bauxite import in October is around 5.36 million tons, down by 5.4% MOM. The import volume from January to October is around 41.05 million tons, up by 75.51% year-on-year.

China imported around 903,000t of bauxite from Australia in October, down by 44.7% MOM. The import from January to October was around 11.79 million tons in total, up by 48.32% year-on-year.

The bauxite import from India was around 52,000t in October, down by 79.5% MOM. The total import from January to October was around 5.01 million tons, up by 666.9% year-on-year.

As a whole, the bauxite import from Indonesia, Australia and India declined in October. However, the total import from January to October jumped greatly compared to 2013, especially for India bauxite. Against the Indonesia bauxite export ban policy, Chinese bauxite buyers purchased large stocks in the past three quarters, leading to rising bauxite import in 2013. Entering the fourth quarter, Chinese buyers reduced import due to high-held stocks and tight capital turn-over. Therefore, Chinese bauxite import went down quickly in October. It is predicted that Chinese bauxite import will go down continuously in the coming two months.

Given the reducing bauxite import, Indonesia bauxite suppliers were forced to lower offers, leading to slight price decrease. The price for Indonesia bauxite reduced from USD52.5/t to USD51.9/t CIF China and the price for India bauxite declined by around USD3/t to USD60.56/t CIF China. Australia bauxite price remained stable. When Chinese buyers cut purchase, India bauxite usually is affected greatly because of its unstable quality.

Chinese buyers turned to purchase high-grade bauxite after the import decrease. For example, it is hard to sell bauxite with Al lower than 45%. India bauxite buyers also focus on bauxite with Al higher than 45%.

Since there is still no change for Indonesia policy, the bauxite suppliers from Indonesia may reduce greatly next year. The suppliers who own export right may focus on some large-scaled miners like Harita and Antam. Therefore, the bauxite price may go up further in 2014. Part Chinese traders also want to replenish high-grade bauxite stocks and sell in future right time.

Chinese bauxite import in October:

Oct |

YOY |

USD/t |

Jan-Oct |

YOY |

|

Bauxite |

6,973,260 |

227.56 |

52.06 |

60,344,842 |

85.95 |

Origin |

|

|

|

|

|

Indonesia |

5,359,585 |

415.59 |

49.74 |

41,051,488 |

75.51 |

Australia |

902,852 |

23.52 |

56.81 |

11,790,925 |

48.32 |

Dominican Republic |

301,52 |

- |

60 |

301,529 |

- |

Guinea |

121,771 |

- |

70.87 |

831,424 |

- |

Ghana |

77,280 |

- |

75.96 |

468,662 |

- |

Fiji |

66,438 |

- |

56.56 |

337,090 |

95.52 |

India |

51,841 |

-81.75 |

59.79 |

5,014,397 |

666.9 |

Malaysia |

48,400 |

-0.29 |

44 |

154,024 |

-19.66 |

Brazil |

43,564 |

- |

81.49 |

365,125 |

- |

Guyana |

- |

-100 |

- |

30,131 |

-42.99 |

Thailand |

- |

- |

- |

46 |

- |